Why tokenization is set to transform the future of capital markets

(Article 1 of 7 in our series on “The capital markets road to tokenization.”)

In recent years, tokenization has quietly but clearly moved beyond the pilot phase. More key market players are integrating distributed ledger technology (DLT) where today’s infrastructure shows structural limitations. J.P. Morgan now processes more than $1.75 trillion in tokenized repo transactions¹ via the Onyx platform; Broadridge processes several hundred billion US dollars per month² via its DLR network; and BlackRock and Franklin Templeton jointly manage over 1 billion US dollars³ in their tokenized money market funds. The issuance of tokenized bonds by UBS, Société Générale, Siemens, and the European Investment Bank has exceeded the 10 billion US dollar mark⁴.

Institutional demand is also reflected in the figures from the Broadridge Tokenization Survey 2025: 63 percent of global custodians already have tokenization services live; 15 percent of asset managers have tokenized products on the market; and 41 percent plan to actively introduce them within the next 24 months. These figures mark a clear transition: tokenization is no longer being tested but is gradually being embedded into existing capital market processes.

At the same time, leading European market infrastructures are working on technical integration. Euroclear is testing the use of DLT in the central settlement stack with the D-FMI program; Deutsche Börse is developing digital issuance and registry processes with D7 and several DLT pilots; and 21X, as the first fully regulated DLT Trading and Settlement System (DLT TSS) operator in the EU, operates an infrastructure in which trading, settlement, and registry management are natively mapped on a blockchain.

Importantly, these projects are not emerging from innovation departments, but from the heart of the systems that are central to efficiency, risk management, and market stability. Today’s capital markets remain limited by a post-trade infrastructure that was never designed for the regulatory, operational, and liquidity requirements institutions face today. In particular, fragmented custodial layers, T+2 settlement cycles, CSDR penalties, and extensive reconciliation obligations create systemic inefficiencies that accumulate across the entire value chain.

Key structural weaknesses can be clearly identified

- Fragmentation: Trading, clearing, settlement, custody, and reporting exist in separate systemsCSDR and MiFID pressure: Settlement discrepancies result in penalties and additional reporting obligations

- Reconciliation: Not a peripheral process, but one of the biggest cost drivers in the back office

- Data inconsistency: each institution maintains its own register; synchronization is error-prone and labor-intensive

- Capital lock-up: The delay inherent in T+2/T+1 settlement necessitates higher capital reserves (e.g., in clearing houses) to manage counterparty risk, creating an opportunity cost. Instantaneous atomic settlement liberates this capital

Blockchain technology directly addresses these issues – its shared, immutable ledger reduces fragmentation and eliminates costly reconciliation, ensures consistent, synchronized data, enables real-time settlement, and frees up capital otherwise tied up in T+1/T+2 processes.

Building on this foundation, tokenization simply digitizes assets and brings them on-chain, allowing markets to fully leverage blockchain’s benefits while modernizing the way value is represented and transferred.

The power of programmability

Programmable assets (tokens) can have logic embedded directly into them, enforcing compliance automatically. For an asset manager, this means a token can, for example:

- Automatically check investor accreditation status before a transfer

- Automatically distribute a dividend or coupon payment the moment the cash is received

- Enforce ESG mandates or jurisdiction-specific rules on-chain, reducing the need for costly manual oversight. This is “compliance-by-design” in action.

It is not a case of “revolutionizing the financial world,” but rather of addressing fundamental technical and organizational problems that can no longer be solved efficiently using traditional means.

Why a programmable register is becoming increasingly necessary

At the same time, the requirements for data quality, transparency, and automation are increasing. MiFID II, CSDR, EMIR, and ESG reporting are adding to the complexity. Markets are becoming more global, products more granular, and expectations for speed and precision are growing. Under these conditions, the question arises as to whether a single, programmable register instead of five separate ones could offer structural advantages.

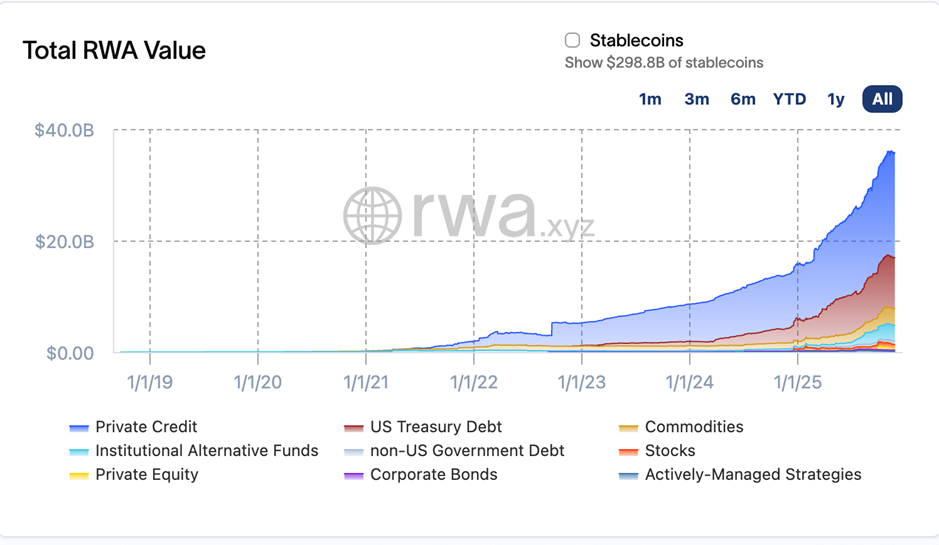

Market data shows that this is not just a theoretical consideration. The growth of tokenized real-world assets (RWA) is real, stable, and institutionally supported. According to RWA.xyz, the volume of tokenized Treasuries and money market products has increased by over 600 percent¹ within a year because of funds, institutional vehicles, and corporate treasury departments. These products are operationally intensive and benefit directly from precise, automated registry structures. Institutional adoption is much more advanced than many people assume².

Fig 1: Total tokenized real-world asset value development sind 2019 (Source rwa.xyz, November 26, 2025)

This strong growth momentum is evident not only in fund volumes, but increasingly also in productive infrastructures. Tokenization has long been in operational use, particularly in repo, collateral management, and investment-grade bonds, considered the most stable areas of the financial markets.

This increasing activity is also reflected in productive systems. BlackRock manages over $2.3 billion in the BUIDL Fund on a public blockchain⁹. Franklin Templeton maintains the register of a US mutual fund on-chain⁸. J.P. Morgan operates the Tokenized Collateral Network (TCN), a productive system that already moves over USD 300 billion in tokenized collateral.

Digital bond issuance has also reached industrial maturity

UBS has issued several digital bonds worth several hundred million Swiss francs each, Société Générale Forge over EUR 100 million, HSBC has issued over USD 250 million via ORION, Siemens has issued a EUR 60 million bond in 2023 and the EIB has issued more than EUR 200 million in fully tokenized bonds.

Together, these examples show that tokenization is productive in core institutional business not experimental. These are real, regulated systems in daily use, not proof-of-concepts.

What’s more, the adoption of tokenization is fundamentally different from the first. Illiquid assets are no longer being artificially fragmented; instead, professional standard instruments are being tokenized.

The adoption of tokenization

Since 2023, the adoption of tokenization is characterized by:

- A focus on institutional products such as bonds, MMFs, fund shares, and collateral

- Compliance-by-design instead of decentralization ideology

- Use of permissioned or permissioned-public architectures

- Focus on programmability instead of token price-driven narratives

- Settlement via regulated digital cash assets (tokenized deposits, bank-backed stablecoins, etc.)

This means that today there is both a regulatory and technologically stable foundation in place.

This development is further supported by forecasts from major institutions. Roland Berger expects tokenization potential to exceed US$10 trillion by 2030⁴. BCG and ADDX are talking about up to US$16 trillion⁵. Citi GPS considers several trillion to be realistic even before 2030⁶. The WEF describes tokenization as “the most profound market structure innovation since dematerialization. It is striking that all models assume extremely conservative tokenization rates – mostly less than one percent of all global assets⁷. Even this minimal share leads to double-digit trillion volumes.

The fact that regulators are actively structuring these developments is adding to the momentum. In its 2024 report, the Financial Stability Board emphasizes that tokenization offers efficiency potential as long as governance, interoperability, and the cash leg are properly regulated³. Europe is going even further with the EU DLT Regime, which allows, for the first time, trading and settlement to be combined on a single DLT system – demonstrating that fragmented post-trade logic can be replaced in totality.

This proactive regulatory stance puts Europe in a unique global leadership situation, and this is exactly where 21X is positioned. The company is the first operator of a fully regulated DLT Trading and Settlement System (DLT TSS) under the EU DLT Regime¹². This status is not just a regulatory label, it enables a new class of market infrastructure where the traditional silos of trading, settlement, and registry management are collapsed into a single, synchronous technical system.

21X is not an experimental blockchain project, but a real alternative to classic market architecture. The approach has tested and proven that a synchronous, programmable registry that combines trading and settlement can reduce operational complexity in the long-term. For banks, asset managers, and issuers, this means the opportunity to actively use tokenization not in the abstract, but within the framework of a fully regulated European system with real products, real processes, and real regulatory requirements.

Conclusion

For institutions that are talking tokenization but do not yet have any operational experience of their own, now is the time for strategic consideration – not in the sense of an isolated experiment, but in a concrete infrastructure decision. The relevant market segments of short-term bonds, money market shares and repo flows can already be productively mapped to DLT today.

So, how does settlement finality change, how do capital commitment, risk allocation, data consistency, and process stability change when trading, settlement, and registry management are brought together in an integrated digital system?

These questions no longer need to be answered theoretically – a regulated, fully-fledged market infrastructure such as 21X, demonstrates this. The technological foundations are in place, the regulatory framework is in place, and the institutional applications are real. Decision-makers who gain their own experience today and for a market in which digital securities registers will no longer be the exception, but the standard.

Those organizations that have already embraced the use of DLT and blockchain-enabled exchanges are demonstrating today the benefits that will actively shape the next phase of the capital market. But while the shift from traditional to tokenized finance is beyond doubt, questions still to be answered include how swiftly it will happen and who will be onboard. And, of course, most important of all – but impossible to answer: Who will be the winners and who will be the losers. Look out for the next installment in the series ‘The capital markets road to tokenization’.

References

- RWA.xyz . Real-World Asset Dashboard.

- Broadridge (2025). Next-Gen Markets — The Rise and Reality of Tokenization.

- Financial Stability Board (2024). Financial Stability Implications of Tokenisation.

- Roland Berger (2023). Real-World Asset Tokenization – Market Outlook 2030.

- Boston Consulting Group & ADDX (2023). Asset Tokenization Report.

- Citi Global Perspectives & Solutions (2023). Money, Tokens and Games.

- World Economic Forum (2023). Future of Capital Markets: Digital Assets.

- Franklin Templeton (2024). FOBXX On-Chain U.S. Government Fund.

- BlackRock (2024). BUIDL Fund Strategy Overview.

- JP Morgan Onyx (2024). Tokenized Collateral Network (TCN).

- Societe Generale Forge (2023). DLT Bond Issuance Documentation.

- European Commission (2022). Regulation (EU) 2022/858 – DLT Pilot Regime.

- Baker McKenzie & Deutsche Bank (2024). The Great Tokenization Shift.

- CFA Institute (2023). Tokenization Primer.