A new architecture for capital-market resilience

by Philip Filhol Senior Business Development Manager @21X

and Benjamin Schellinger Business Operations Manager @21X

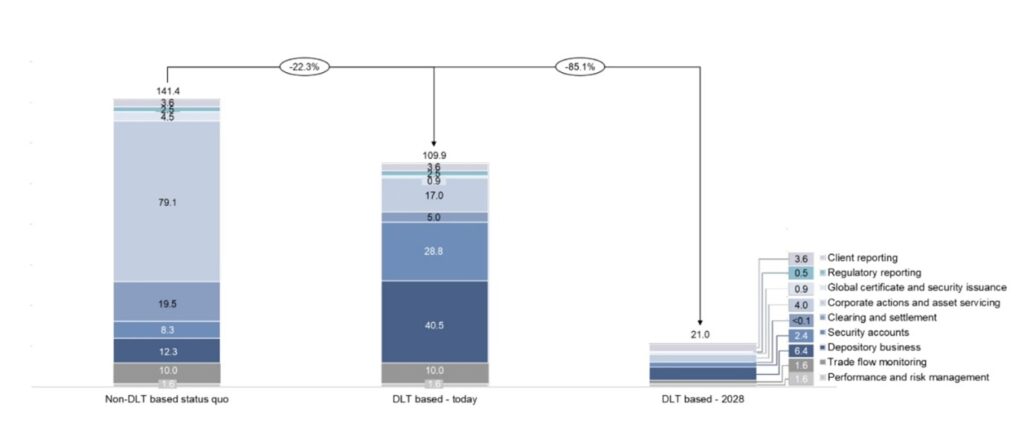

Distributed ledger technology (DLT) is no longer just an experimental field in the crypto sphere, but is increasingly being positioned as a lever for significant cost and capital relief in the regulated capital market. For many years, the post-trade infrastructure – encompassing settlement, clearing, reconciliation, corporate actions, and payment transactions – has been considered one of the most expensive elements of the financial system. Estimates put global post-trade costs at USD 15–20 billion per year¹. However a recent study by Cashlink and FinPlanet, highlights potential savings of up to 85% in middle and back office processes by 2028, and even today, depending on the setup, cost reductions of up to 22% are already realistic² through the implementation of DLT.

For banks, asset managers and supervisory authorities, the question is no longer whether DLT can bring efficiency, but rather which infrastructure models actually leverage these effects and what regulatory, technical and organisational requirements they need.

Today’s cost base is a fragmented infrastructure

The reasons for high post-trade costs are structural in nature. Each institution maintains its own register; each transaction must be confirmed multiple times; and even simple corporate actions go through multi-stage validation processes. The ECB explicitly refers to reconciliation as one of the ‘key structural cost drivers’ in post-trade⁴. Added to this is the dependence on traditional payment transactions, especially in the international environment: pre-financing, corresponding bank chains and FX dependencies result in high fees and operational risks⁵.

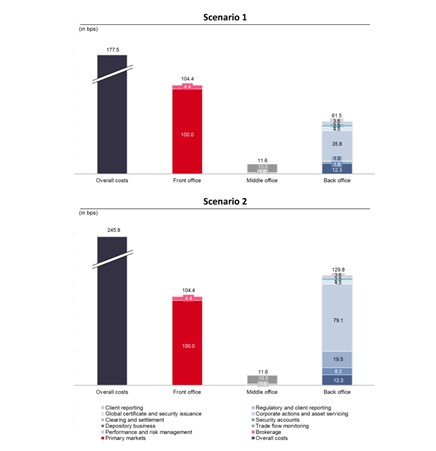

Fig 1: Costs of existing non-DLT capital market infrastructure processes in scenario 1 and scenario 2 (in bps) (Source: Cashlink, FinPlanet, Cost savings potential of DLT based capital market infrastructures – a quantitative analysis, 2023)

Corporate actions are among the costliest process blocks in the custody and servicing business. Analyses show that this is where a significant portion of back-office costs arise – primarily due to manual verification and bilateral reconciliation⁴.

How DLT reduces costs

DLT addresses not isolated sub-processes, but the structural cause of the costs – the lack of a common infrastructure. The following mechanisms are consistently described across studies and underpinned by practical examples.

- A common database instead of multiple reconciliation

A synchronized register replaces several independent ledgers. The result: Less reconciliation effort, fewer errors and less exception processing.

- Automation of corporate actions

Smart contracts can deterministically map coupons, redemptions and tax mechanics. Scenario analyses show that this can reduce the effort required for corporate actions by up to half.

- Real-time settlement to reduce capital commitment

Settlement in seconds shortens exposure times. The GFMA and BIS emphasise that this can improve margins and reduceiquidity buffers and clearing fund contributions – with potential benefits in the high double-digit to triple-digit million range for large institutions⁶.

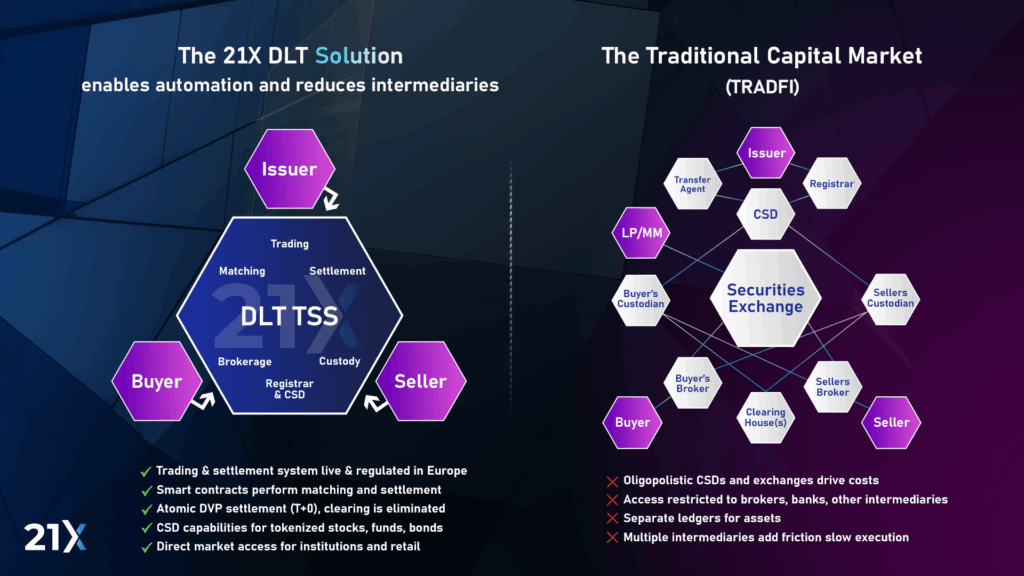

- Reduction in intermediaries

Peer-to-peer settlement reduces technical interface chains. The EU Payments Roadmap describes the elimination of certain intermediary layers as a ‘substantial cost reducer’⁷.

- Efficiency in cross-border payments

International payment flows benefit because fee chains, pre-funding requirements and FX complexity are reduced. Analyses show significant efficiency gains compared to traditional correspondent banking models⁵

These mechanisms do not work in isolation, but along the entire value chain.

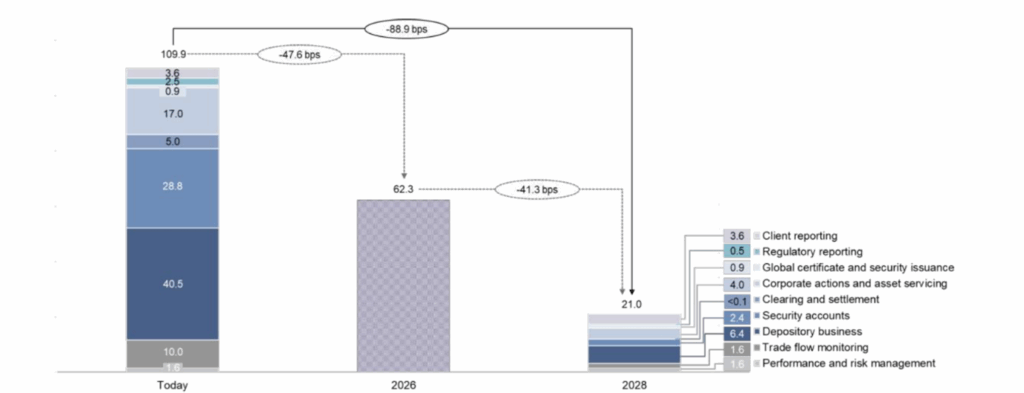

Fig 2: Coasts of DLT based capital market infrastructures in 2026, in 2028, and as of today (in bps) (Source: Cashlink, FinPlanet, Cost saving potential of DLT based capital market infrastructure – a quantitative analysis, 2023)

Fig 3: Cost impact analysis of scenario 1 (in bps) (Source: Cashlink, FinPlanet, Cost saving potential of DLT based capital market infrastructure – a quantitative analysis, 2023)

Fig 4: Cost impact analysis of scenario 2 (in bps) (Source: Cashlink, FinPlanet, Cost saving potential of DLT based capital market infrastructure – a quantitative analysis, 2023)

Real-world figures: The transition from model to reality

Several studies show a consistent pattern:

- 60–85% potential cost reductions in middle and back office processes

- Up to ~50% less effort for corporate actions

- Significant capital relief through shorter settlement cycles⁶

- Noticeable efficiency gains in cross-border transactions⁵

Institution-specific impact models

Large universal banks (USD 500+ billion in assets):

• Middle/back-office cost savings: USD 150-200 million annually¹

• Reductions in capital tied up through T+0 settlement: £300-500 million⁵

• Reductions in intermediary costs: £50-80 million annual relief⁶

Asset managers (100+ billion USD AUM):

• Corporate actions automation: 25-40 million USD in annual savings⁴

• NAV process optimization: 10-15 million USD in annual savings¹

• Custody cost reductions: 15-25 million USD per year⁷

Custodian banks:

• Settlement cost reductions: 140-210 million USD annually¹

• Operational risk reductions: 40-70 million USD in annual relief²

• Cross-border efficiencies: 70-110 million USD in annual efficiency gains³

In its maturity analysis of KfW blockchain bonds, KPMG confirms that DLT contributes to process optimisation in the capital market and works in a regulated environment⁸.

The same logic applies to tokenised bonds, which are particularly suitable for automated corporate actions, deterministic settlement and reduced reconciliation processes. Results from KfW pilot issues and GFMA analyses confirm that DLT has one of the greatest potentials for cost reduction here.

The missing piece: Digital money determines actual efficiency

Across multiple studies, a consistent conclusion emerges. The EU DLT Payments Report, ECB publications and analyses by Cashlink and FinPlanet all emphasise the same point:

The greatest efficiencies can only be achieved when the means of payment is also digital and on-chain.

A tokenized security whose payment leg continues to run via traditional rails recreates the very breaks that DLT is intended to eliminate. Only the integration of digital means of payments – such as stablecoins, e-money tokens or tokenised deposits – enable true, atomic delivery versus payment (DvP), while reducing settlement risk and capital commitment.⁷

Relevance for 21X: Cost efficiency becomes operationally measurable

DLT cost efficiency is no longer a theoretical model. Products that demonstrate these mechanisms in practice are already being processed via 21X.

One example is the tokenised note on the high-performing UBS (Irl) Select Money Market Fund – USD, which provides corporate and institutional investors with regulated, blockchain-based exposure to a money market fund. Trading of existing units takes place via the 21X order book and which is settled atomically on-chain, reducing operational complexity compared to traditional fund distribution models. 21X trading participants have instant access to an attractive yield-bearing instrument.

From a treasury perspective, such structures illustrate how tokenised money market instruments can support more flexible liquidity management and shorter effective holding periods. Use cases of this nature, including those explored with partners such as Brick Towers, highlight the potential of regulated DLT market infrastructure to streamline treasury and cash management processes. DLT markets move on-chain for trading of attractive products.

Conclusion

21X combines the key building blocks of the DLT efficiency chain – a shared ledger for trading and settlement, integrateable digital means of payment, programmable lifecycle logic and full supervision under the EU DLT pilot regime. This means that, for the first time, cost effects can not only be modelled but also measured empirically.

The evidence is conclusive: Distributed Ledger Technology, when paired with on-chain digital money, is the essential architecture for capital market resilience and substantial cost reduction. 21X has solved the efficiency equation by combining all critical component – a supervised DLT infrastructure, a shared settlement ledger, and integrateable digital payment rails – allowing institutions to bypass reconciliation complexity and unlock hundreds of millions in yearly savings and capital relief. The path to a competitive and resilient operating model is clear – partner with 21X to move beyond theoretical savings and implement the next generation of cost-efficient financial infrastructure.

References

¹ Santander / GFMA analyses of global savings potential

² Cashlink / FinPlanet – DLT cost savings study (IT-Finanzmagazin)

³ IT Finance Magazine – ‘Up to 85% savings potential in the capital market through DLT’

⁴ Yogesh K. Pant – Cross-Border Payments Analysis

⁵ GFMA – Capital efficiency analysis / Settlement cycles

⁶ EU Payments Roadmap – Efficiency through digital money

⁷ KPMG/KfW – Maturity analysis of blockchain-based bonds

⁸ 21X – MMF rating, treasury use cases and product descriptions