How yield-bearing stablecoins are rewriting the rules of adoption

by Jakob Bosshard Head of Business Operations @21X

Traditional stablecoins offered settlement speed, but the next generation offers regulated yield. Is this the innovation that finally bridges the gap between DeFi and the institutional balance sheet?

Stablecoins are evolving into a new form of institutional liquidity. What once began as digital cash is increasingly becoming an integral part of modern treasury and capital market management. At the same time, a growing segment – yield-bearing is emerging, including digital tokens that reflect or pass on returns from the underlying assets. This development marks the transition from passive, transaction-oriented cash to active, programmable capital.

The market has now reached a tipping point. According to consolidated data from Defi Lama, the value of stablecoins in circulation in November 2025 was around $307 billion, more than twice as much as in 2022. This growth reflects acceptance in institutional payment and settlement processes, but also growing interest in yield-bearing structures that are both regulatory compliant and technologically efficient.

Regulatory framework: Stability yes, interest only under supervision

The European Markets in Crypto-Assets Regulation (MiCA) draws a clear line: issuers of e-money tokens (EMT) and asset-referenced tokens (ART) may not grant interest or equivalent benefits based on the holding period (Articles 40 and 50 MiCA). This interest prohibition also applies to all crypto service providers offering EMT or ART services. EU law thus makes a strict distinction between the payment function of a stablecoin and an income component, which, if at all, must be realized outside the token, for example via fund or securities structures.

In the United States, the GENIUS Act, passed in July 2025, created a uniform federal framework for stablecoins. Here, too, issuers are prohibited from paying directly any interest on stablecoins. At the same time, the Act opens up the possibility of mapping yield structures via regulated investment vehicles or banking products, provided they comply with the relevant securities and supervisory rules. This creates a dual model: payment stablecoins remain interest-free, while yield-bearing tokens are treated as fund or securities shares.

Hong Kong and Singapore are pursuing similar approaches. Hong Kong completely prohibits interest-bearing stablecoins, While Singapore only allows interest components for professional investors under strict disclosure and consent requirements. So, a global consensus is emerging whereby issuance and yield generation must remain separated, as laid out by regulations.

Structural models for yield-bearing stablecoins

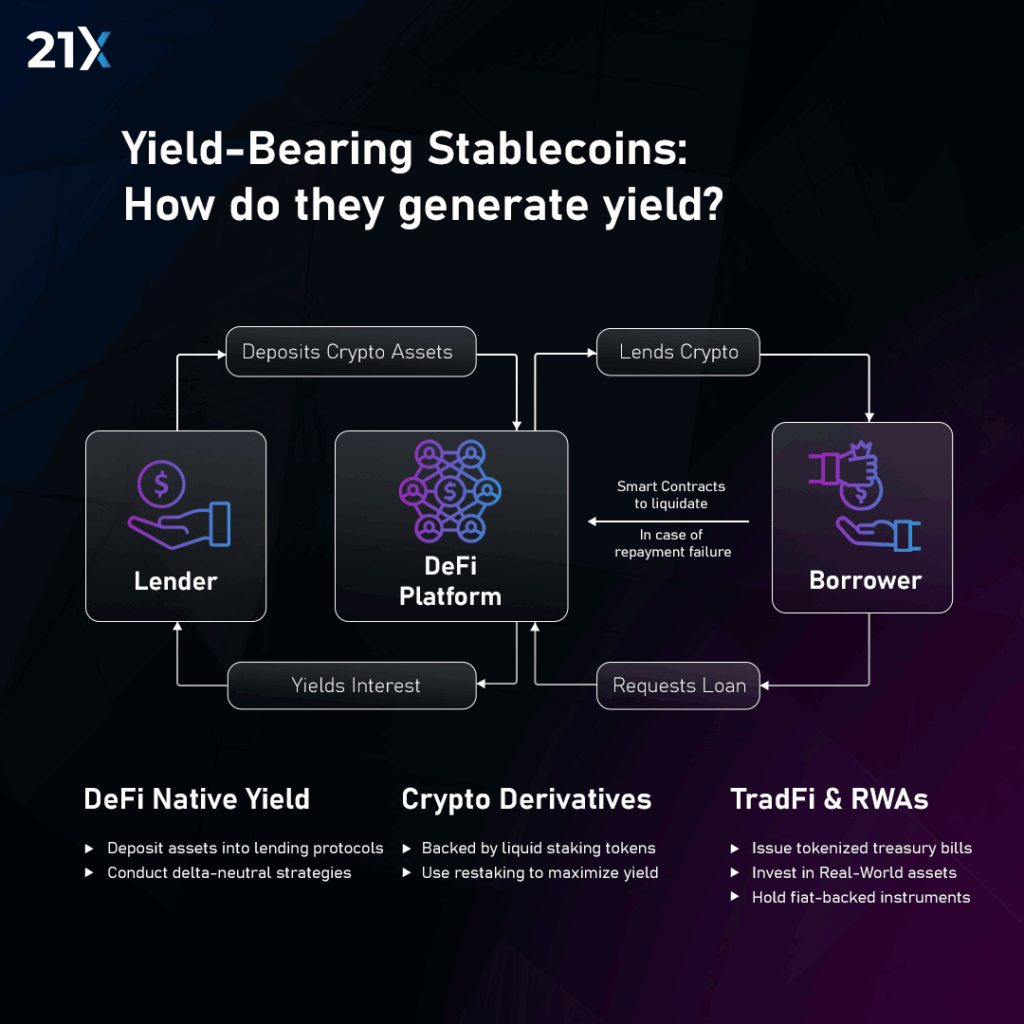

Within these legal boundaries, three design patterns have emerged that enable yields without violating the interest prohibition:

Tokenized money market funds (MMFs)

Institutional pioneers such as Franklin Templeton through its (fund name?), the on-chain U.S. Government Fund, FOBXX and BlackRock, with its BUIDL Fund, structure their tokens as fund shares that invest in U.S. Treasuries, cash, and repos. The returns are credited on-chain, while ownership and reporting requirements follow traditional fund rules. These products are not stablecoins in the strict sense, but tokenized fund shares that have daily NAV, embedded, regulation and 24/7 transferability.

Treasury-backed stablecoin variants

Models such as Mountain Protocol USDM use rebasing mechanisms: the token value remains at USD 1, while the number of holders increases in proportion to the interest income. The source of income is short-term US government bonds, which are held entirely off-chain. Such structures are common outside the EU but come up against the interest prohibition rules of the MiCA framework.

DeFi wrappers and separation models newer projects technically separate principal and income. The stablecoin itself remains interest-free, while a separate smart contract or vault bundles the income generated. This allows for the regulatory argument that interest is not paid on the coin, but on a separate position subject to fund law.

What all approaches have in common is that they maintain a 1:1 relationship to a stable reference currency, while returns are distributed or accumulated transparently via smart contracts. The widely used ERC-4626 standard facilitates the accounting and interoperability of such interest-bearing vaults.

Practical application and institutional use

Companies are beginning to integrate stablecoins into operational financial processes. PayPal introduced PYUSD as a payment stablecoin for customers and merchants; JPMorgan is using its Onyx Coin system for real-time settlement of intra-group and cross-border payments.

These applications demonstrate measurable efficiency gains. A study by Vantage Bank shows that stablecoin-based cross-border payments can reduce transaction costs by around 96 percent – from $6.78 to $0.28 per transfer. At the same time, tokenized money market funds make possible for the first time a shift of excess liquidity intraday into interest-bearing instruments and make it available again immediately when needed. Staying on-chain for the entire core process is the key to gaining efficiency. This opens up:

- A new range of tools for treasury departments

- Daily allocation of excess liquidity to regulated short-term funds

- 24/7 settlement capability without intermediary delays

- Automated rebalancing via smart contracts or AI-based agents

Infrastructure and supervision: 21X as a regulated bridge

For the above-mentioned structures to function in a legally compliant manner, regulated marketplaces are needed to combine tokenization, custody, and settlement. 21X, as a financial market infrastructure approved under the EU DLT pilot regime, offers an environment in which tokenized securities and stablecoins can be settled atomically and in a legally binding manner. This infrastructure allows for:

- Settlement in seconds between regulated counterparties

- Transparent custody and auditability; andIn the future, secondary trading of tokenized money market funds and short-term instruments

For issuers, fund managers and companies, this creates an infrastructure that combines programmable liquidity with regulatory certainty.

Outlook: The emergence of an on-chain yield curve

With the ongoing tokenization of money market and government bond instruments, a digital yield curve is emerging – from interest-free stablecoins to 30- and 90-day T-bill tokens to fully-fledged tokenized fund shares. This curve forms the basis for a new, efficient on-chain liquidity ecosystem in which capital can be allocated, earn interest, and settled around the clock.

By unifying MiCA regulation, the DLT pilot infrastructure, and transparent fund standards, Europe supported by regulated platforms like 21X is establishing the framework for a legally compliant and interoperable on-chain financial system. Yield-bearing stablecoins exemplify this market integration: merging stability with yield, automation with supervision, and delivering real-time, regulated money market mechanics.

Yield-bearing stablecoins exemplify the next stage of market integration as hey combine stability with yield, automation with supervision, and demonstrate how money market mechanisms can be replicated in real time and under regulatory control.

Conclusion

Interest-bearing stablecoins are not a marginal phenomenon, but an indicator of the transition to a continuously optimized financial architecture. Their success depends not only on technology, but also on legally secure governance, transparent yield structures, and audited market infrastructure. Europe has the legal and technical prerequisites to actively shape this change efficiently, transparently, and compliantly.

(Sources: MiCA Regulation (EU) 2023/1114 Art. 40 and 50; GENIUS Act (2025); FSI Brief No. 27; Roland Berger “Future of Payments” 2024; K33 Research “Definitive Guide to Stablecoins” 2025; BIS FSI Notes 2025; Franklin Templeton Fund Prospectus 2025; BlackRock BUIDL Report 2025; DefiLlama Stablecoin Dashboard Nov 2025; Vantage Bank Case Study 2024.)