AMINA Becomes First Regulated Bank on 21X, Europe’s First Fully Regulated DLT Trading and Settlement Venue

Along with Tokeny, the combined tokenisation suite creates a complete tokenisation infrastructure, from regulated custody to onchain trading and settlement Zug, Switzerland & Frankfurt, Germany — 9 March 2026 — AMINA Bank AG (“AMINA”), a Swiss Financial Market Supervisory Authority (FINMA)-regulated crypto bank with global reach, today announces it has become a listing sponsor on 21X, […]

21X appoints Marek Socha as Managing Director, Global Markets to drive global expansion and institutional partnerships

Frankfurt, Germany: 2 March 2026 – 21X, the first fully regulated exchange in the European Union (EU) for digital securities, has today announced the appointment of Marek Socha as Managing Director, Global Markets. With over 17 years’ experience across financial services, digital securities, and financial market infrastructure (fmi), he joins 21X at a pivotal inflexion […]

Digital competitiveness and the MISP: Timing is what matters

– DLT alliance calls on the EU to act now on the DLT Pilot Regime – FRANKFURT – February 5, 2026: Together with the Alliance of Authorised DLT Market Infrastructure Operators and Applicants under the EU DLT Pilot Regime, 21X – the world’s first fully regulated distributed ledger technology-based trading and settlement system (DLT TSS) […]

21X and LeveL Markets partner to offer tokenized capital markets trading

FRANKFURT & BOSTON – January 29, 2026: 21X, the world’s first fully regulated DLT-based trading and settlement system (TSS), today announced a strategic partnership with LeveL Markets, which offers industry-leading connectivity to a diverse international trading ecosystem, to offer digital trading services by connecting traditional financial markets with next-generation, wallet-based trading rails. The partnership brings […]

21X and SOOHO.IO announce collaboration to explore stablecoin FX

– Partnership to accelerate institutional stablecoin FX operations and the regulated tokenized securities market – FRANKFURT, Germany/ SEOUL, South Korea – December 19, 2025: 21X – Europe’s first fully licensed DLT trading and settlement system under the EU DLT Regime – and SOOHO.IO – the leading Korean blockchain fintech powering Project Namsan, an institutional consortium […]

21X technically integrated on the Stellar network, solidifying its position as a regulated multi-chain trading venue

FRANKFURT, Germany – 18 December, 2025: 21X, Europe’s first fully regulated DLT Trading and Settlement System (DLT TSS), today announced the technical availability of its regulated trading venue for tokenized securities on the Stellar network. This milestone confirms Stellar as the second public blockchain available on 21X, cementing the company’s position as a technology-agnostic market […]

Jens-Thorsten Rauer appointed as Member of the Supervisory Board of 21X AG

– 21X strengthens its governance and leadership as DLT marketplace continues to expand – FRANKFURT, 9 December 2025 – 21X, the leading blockchain-enabled exchange for tokenized financial instruments, today announced the appointment of Jens-Thorsten Rauer as a Member of the Supervisory Board of 21X AG. With more than 30 years of international leadership experience across […]

21X deploys NCC Group’s iMXDR service to secure Europe’s first fully regulated digital asset exchange

3 December 2025 – NCC Group, a people-powered, tech-enabled global cyber resilience business has been selected by 21X to secure Europe’s first fully regulated exchange for digital assets. 21X is the first financial institution licensed to operate a regulated trading and settlement venue under the Distributed Ledger Technology (DLT) Regime. NCC Group will provide cyber […]

ISP Securities Ltd joins 21X as a listing sponsor and trade participant – opening regulated access to tokenized securities for issuers and investors

– Established Swiss financial services provider supports issuers with structuring and listing of tokenized equity and debt instruments on 21X, whilst enabling clients direct access to trading tokenized securities – Frankfurt – 14 October 2025: 21X, Europe’s first fully regulated trading and settlement system for digital securities (DLT TSS), today announced that ISP Securities Ltd. […]

21X to appoint John Linnehan as CEO of the 21X U.S. entity and bring world’s first fully regulated on-chain trading and settlement system for digital securities to America

Seasoned financial strategist joins 21X to drive adoption and regulatory approval of digital securities in the world’s largest capital market Frankfurt – 9 October, 2025: 21X, a leader in regulated on-chain trading and settlement, today announced a major step in its U.S. market expansion with the announcement that it will appoint John Linnehan as the […]

21X to establish U.S. operations, bringing world-class blockchain-based exchange to the American market

– Announcement marks a pivotal moment for on-chain finance as 21X prepares to launch in the world’s largest capital market – Frankfurt – 2 October, 2025 – 21X, a leader in regulated on-chain trading and settlement, today announced it will be expanding into the United States and is working to establish a new operation incorporated […]

21X and DekaBank successfully complete on-chain trade on the Polygon Testnet

– Positive tests lay the foundation for wallet-based trading of tokenized financial instruments – Frankfurt, Germany – 30 September 2025: 21X, the operator of the first EU-regulated on-chain trading and settlement system, and DekaBank, the securities services provider of the German Savings Banks Finance Group (Sparkassen-Finanzgruppe), today announced the successful completion of an on-chain trade […]

21X hosts inaugural On-chain Capital Markets Summit, celebrating a new era for capital markets

Frankfurt, Germany – September 25, 2025: 21X, the world’s first exchange fully regulated to operate in the EU that enables smart contract-based matching and settlement of financial instruments on the blockchain, is hosting its inaugural On-chain Capital Markets Summit on the evening of October 1, 2025, at the magnificent New Opera House in Frankfurt. The […]

First EU-Regulated Onchain Exchange 21X Adopts Chainlink Live in Production

Frankfurt, Germany: September 15, 2025 — Chainlink, the industry-standard oracle platform, and 21X, the first blockchain-based exchange for tokenized securities licensed under the EU’s DLT Regime, today announced that 21X has integrated the Chainlink data oracles to deliver market data onchain for its tokenized securities. Live-in-production and powered by the Chainlink Runtime Environment (CRE), Chainlink […]

21X and Stellar Open Regulated Pathways for Tokenized capital markets

– First-ever regulated secondary market for tokenized securities launches on Stellar making previously illiquid investments more accessible – FRANKFURT, 10 September 2025: 21X, Europe’s first fully regulated Distributed Ledger Technology based trading and settlement system (DLT TSS), today announced the launch of 21X on the Stellar network as part of its multichain expansion. This collaboration […]

21X rings the bell as trading starts on the world’s first blockchain-based exchange for tokenized securities and stablecoins

– Pioneering digital asset exchange is the first regulated financial market infrastructure globally to enable atomic trading and settlement of securities – FRANKFURT, GERMANY – 8 September 2025: Heralding a new era for global capital markets, 21X has today announced the launch of its exchange for tokenized cash and securities. As the world’s first exchange […]

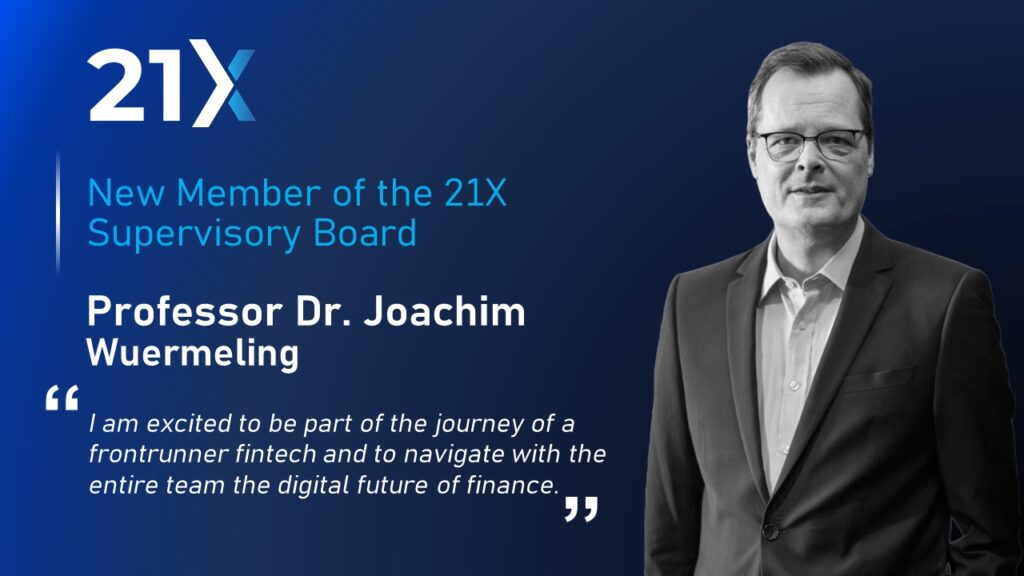

Prof. Dr. Joachim Wuermeling appointed as Member of the 21X Supervisory Board

– Company strengthens leadership ahead of 21X secondary market launch – FRANKFURT, 27August 2025: 21X – the leading blockchain-based exchange for tokenized financial instruments – today announced the appointment of Prof. Dr. Joachim Wuermeling as member of the company’s Supervisory Board. Prof. Dr. Wuermeling brings a distinguished career in finance, regulation, and governance, positioning 21X […]

Tradevest appointed as market maker on the 21X digital asset exchange

Munich, 13 August 2025 – Tradevest, a leading provider of digital infrastructure for financial institutions, has today announced that it is acting as the first market maker for 21X, Europe’s first fully regulated DLT-based trading and settlement system (DLT TSS) to operate in the EU. This strategic collaboration marks a significant milestone in the development […]

Noumena Digital and 21X announce strategic partnership to drive expansion of tokenized securities market across Europe

ZUG, SWITZERLAND & FRANKFURT, GERMANY – July 21, 2025: Noumena Digital, a Switzerland-based technology provider of bank-grade gateway infrastructure, and 21X, a Frankfurt-based pioneer in blockchain-enabled capital markets, today announced a strategic partnership to accelerate the institutional adoption of tokenized securities across Europe. This partnership combines Noumena’s trust-native, blockchain-agnostic digital asset middleware with 21X’s regulated […]

21X and SwissFinTechLadies partner to accelerate female-led innovation in digital finance

FRANKFURT, 7 July 2025: 21X, the first financial institution licensed to operate a regulated trading and settlement venue for tokenized financial instruments in the EU under the distributed ledger technology (DLT) Pilot Regime, today announced a partnership with SwissFinTechLadies (SFTL), a prominent association dedicated to empowering women in finance, technology, and blockchain. This collaboration underscores […]

Particula Joins 21X as Official Listing Sponsor as 21X Prepares to Launch a Fully Regulated Digital Asset Exchange

FRANKFURT, 3 July 2025: 21X – the first fully regulated DLT-based trading and settlement system (DLT TSS) in Europe – today announced a strategic partnership with Particula, the prime rating provider for digital assets. Particula will act as an official listing sponsor on 21X’s regulated on-chain exchange. The collaboration leverages Particula’s advanced capabilities in the […]

21X congratulates AllUnity on securing its BaFin E-Money Institution license, allowing for regulated EUR stablecoin settlement

FRANKFURT – 2 July 2025: 21X, the first EU-regulated trading and settlement infrastructure for digital assets under the DLT Regime, today congratulates its strategic partner, AllUnity, on receiving its E-Money Institution (EMI) license from the German Federal Financial Supervisory Authority (BaFin) on July 1, 2025. This pivotal achievement marks a significant step forward for the […]

ECB publishes landmark DLT wholesale settlement report following trials and experiments in which 21X was a participant

FRANKFURT, 1 July 2025: 21X, the first financial institution licensed to operate a regulated trading and settlement venue for tokenized financial instruments in the EU under the DLT Regime, notes today’s publication by the European Central Bank (ECB) of its report on the Eurosystem’s exploratory work on new technologies for wholesale central bank money settlement. […]

ESMA’s report calling for a strengthened DLT Pilot Regime fuels 21X’s ambition for digital capital markets

FRANKFURT, 30 June 2025: 21X, the leading DLT-based exchange for tokenized financial instruments, today expressed strong approval for the European Securities and Markets Authority (ESMA)’s newly published Report on the Functioning and Review of the DLT Pilot Regime – Pursuant to Article 14 of Regulation (EU) 2022/858 (DLTR).1 The report aligns directly with 21X’s long-standing […]

Cordial Systems makes their MPC Wallet Infrastructure compatible with 21X

FRANKFURT, 26 June 2025: 21X, the first financial institution licensed to operate a regulated trading and settlement venue for tokenized financial instruments in the EU under the DLT Regime, today announced a collaboration with Cordial Systems, a leading provider of zero-trust, MPC wallet infrastructure for institutional digital asset custody. The partnership enables institutional participants to […]

21X and d-fine partner to accelerate DLT integration for institutions

FRANKFURT – June 23, 2025: 21X, the first fully regulated distributed ledger Technology Trading and Settlement System (DLT-TSS) licensed to operate in the EU, today announced a strategic partnership with d-fine GmbH, a leading European technology and consulting firm. This collaboration boosts 21X’s capacity to onboard institutional clients onto its groundbreaking market infrastructure. The partnership […]

Brick Towers joins 21X as a trading participant for on-chain treasury management

FRANKFURT, 29 May 2025: 21X, the first financial institution licensed under the EU DLT Regime to operate a fully regulated trading and settlement venue for tokenized financial instruments, has welcomed Brick Towers as a trading participant on its blockchain-based infrastructure. The announcement follows the successful go-live of 21X’s regulated primary market last week, marking a […]

USDC to power atomic settlement on 21X’s regulated trading venue

FRANKFURT, 2 June 2025: 21X, the first financial institution licensed under the EU DLT Regime to operate a fully regulated trading and settlement system for tokenized securities, has announced the integration of USDC as a key settlement currency on its platform. This marks a significant step forward in streamlining digital asset transactions within the European […]

Tokenized Note on UBS Money Market Fund opens for subscription on 21X

Black Manta Capital Partners and SBI Digital Markets offer US Money (USMO) – a tokenized note on UBS (Irl) Select Money Market Fund – USD – through 21X FRANKFURT, 20 May: 21X – Europe’s first fully regulated DLT trading and settlement system – has today announced the opening of the primary market phase of 21X […]

21X appoints Ralf Wandmacher as COO and CFO, strengthening the company’s management board

FRANKFURT, 16 May 2025: 21X – Europe’s first fully regulated DLT trading and settlement system – has today announced the appointment of Prof. Ralf Wandmacher as its Chief Operating Officer (COO) and Chief Financial Officer (CFO), effective immediately. Mr. Wandmacher will also join the company’s management board, bringing a wealth of experience from both traditional […]

21X and Quantoz partner to enable atomic settlement of tokenized securities with regulated stablecoins

FRANKFURT, 15 May 2025: 21X – the first financial institution licensed under the EU DLT Regime to operate a regulated trading and settlement venue for tokenized securities – has entered a partnership with Quantoz Payments, a licensed Dutch e-money institution (EMI) and issuer of stablecoins designed to be compliant with MiCA regulation. Quantoz, based in […]

21X and Zühlke announce strategic partnership to accelerate institutional adoption of tokenized securities trading

FRANKFURT, 13 May 2025: 21X, the first licensed DLT trading and settlement system (DLT TSS) in Europe, and Zühlke, a global innovation and transformation partner, today announced a strategic partnership aimed at accelerating the adoption of tokenized securities trading among institutional clients. This collaboration leverages 21X’s groundbreaking DLT TSS and Zühlke’s deep expertise in financial […]